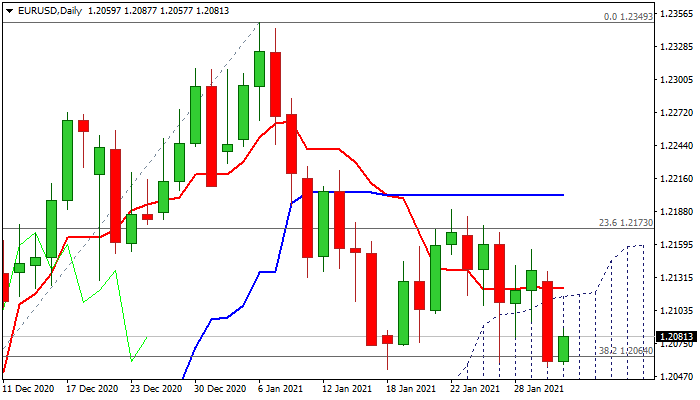

Penetration of thick daily cloud further weakens near-term structure

Larger bulls got in more troubles after Monday’s 0.57% drop and eventual close within thick daily cloud.

Bearish acceleration also managed to register a marginal close below pivotal Fibo support at 1.2064 (38.2% of 1.1602/1.2349) on Monday, but so far stays above the last pivot at 1.2053 (Jan 18 low).

Recovery attempts in early Tuesday’s trading were so far limited as negative daily techs (multiple MA bear-crosses / momentum holding in the negative territory / Tenkan-sen and Kijun-sen in bearish setup) weigh heavily.

Eventual break of 1.2053 would signal bearish continuation of pullback from 1.2949 (2021 high) and expose psychological 1.20 support, with stronger bearish acceleration to risk test of 1.1976 (50% retracement of 1.1602/1.2349) and 1.1937 (daily cloud base).

Broken cloud top (1.2115) and daily Tenkan-sen (1.2122) mark strong barriers, break of which would neutralize immediate downside risk.

Res: 1.2087; 1.2115; 1.2122; 1.2155

Sup: 1.2053; 1.2000; 1.1976; 1.1937