Bears face headwinds from 200DMA / upbeat German data

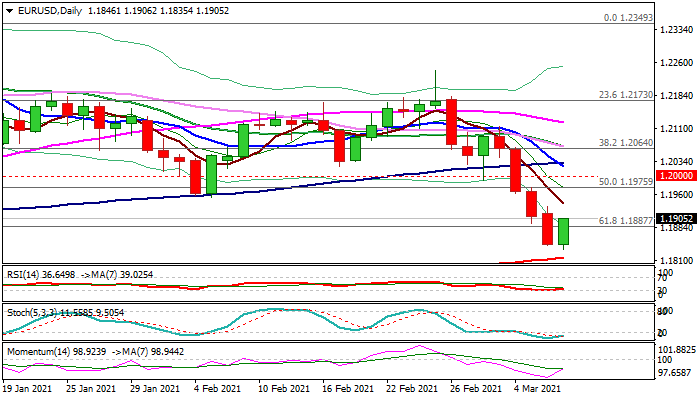

The Euro bounces from new 3 ½ low (1.1835) on Tuesday, as steep fall in past four days stalled on approach to 200DMA (1.1816), offsetting for now bearish signal on Monday’s close below 1.1887 (Fibo 61.8% of 1.1602/1.2349 upleg).

Better than expected German export data and widened trade surplus improved the sentiment and lifted the single currency.

Daily stochastic reversed in oversold territory and RSI turns north, while negative momentum is fading and helping recovery.

Daily cloud is thinning and twists next Monday that could be also magnetic.

Recovery faces initial resistance at 1.1931 (Monday’s high / Fibo 23.6% of 1.2242/1.1835), with extended upticks to stall under key barriers at 1.1991/1.2000 (Fibo 38.2% / psychological) and provide better opportunities to re-join bearish market.

Caution on sustained break above 1.20 pivot that would signal reversal.

Res: 1.1931; 1.1976; 1.2000; 1.2023

Sup: 1.1835; 1.1816; 1.1778; 1.1745