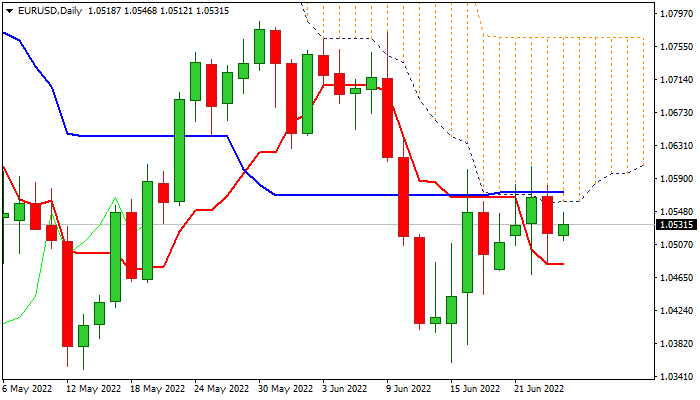

Thick daily cloud continues to limit recovery attempts

The Euro kept slightly positive stance in a quiet early Friday’s trading, as stocks edged higher, but lacking direction as near-term action holds within a range, defined by 10 and 20DMA’s, for the third straight day and capped by thick daily cloud.

Technical studies are bearishly aligned on a daily chart as momentum remains negative and stochastic turns south, though recovery from June 15 low at 1.0358 remains alive while the price stays above 10DMA (1.0495), but with limited upside prospects for now.

Traders eye German Ifo business climate data (June 92.9 f/c vs May 93.0) for fresh signals, if the figure significantly diverges from expectations, with end of week position liquidations to possibly further move the price.

Look for signals on break of 10DMA which could soften near-term tone and shift focus towards key supports at 1.0358/49/40, loss of which would signal bearish continuation.

This so far looks as preferred scenario as the action remains heavily weighed by a massive daily cloud ( 1.0560/1.0767) and negative fundamentals, driven by weak economic data that raise recession fears.

Only sustained penetration of daily cloud and close above 20DMA (1.0591) would ease downside pressure and allow for stronger rebound, although, overall bias is expected to remain with bears while the action stays below 1.0767/86 (daily cloud top / May 30 lower top).

Res: 1.0560; 1.0591; 1.0621; 1.0685

Sup: 1.0495; 1.0459; 1.0380; 1.0358