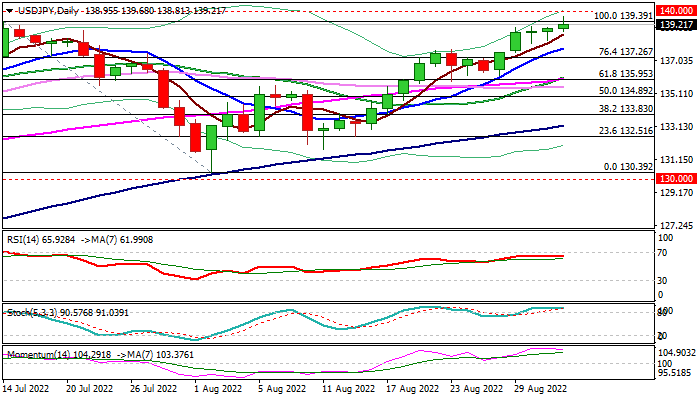

USDJPY hits new 24-year high, pressures psychological 140 barrier

The USDJPY posted new 24-year high on break through former 2022 peak, posted in July.

The dollar remains strongly underpinned by a hawkish stance of Fed, as many market participants bet for another 75 basis points rate hike in the policy meeting later this month, as Fed expressed its strong commitment to restore price stability by tightening its monetary policy, even at cost of significant slowdown in economic growth.

On the other side, the Bank of Japan sticks to its ultra-loose policy and widening gap between the policies of two central banks would continue to be a main driver of the greenback against yen.

Although bulls cracked key barrier at 139.39, headwinds should be expected here as daily studies are overbought.

Limited dips (ideally to be contained at 128.00/137.80 zone) should offer better buying levels for clear break of 139.39 pivot and test of psychological 140 barrier, with further acceleration higher on break of 140 barrier, not ruled out on current conditions or more hawkish signals from the US central bank.

Res: 139.68; 140.00; 141.51; 142.82

Sup: 138.63; 138.05; 137.80; 137.26