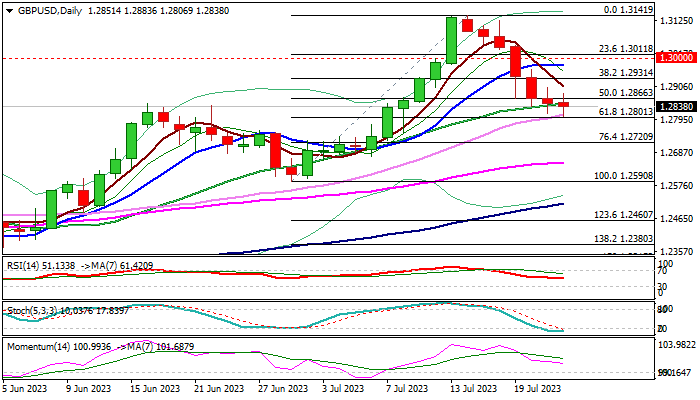

GBPUSD – second Doji signals that bears might be losing traction

Cable edged lower in early Monday and hit new marginally lower two-week low, after bears probed through pivotal supports at 1.2866/48 (Fibo 50% of 1.2590/1.3141 / 20DMA) though losses were limited and near-term action influenced by Friday’s Doji candle, being so far in the same shape.

Bears pressure next pivot at 1.2801 (Fibo 61.8%) violation of which would further weaken near-term structure for deeper pullback.

On the other hand, oversold stochastic and neutral RSI, suggest that bears may take a breather above 1.2800 zone, with bearish bias expected to remain intact while the price action stays below broken Fibo 38.2% level at 1.2931, while acceleration through upper pivots at 1.2974/1.3000 (10DMA / psychological) would revive bulls and signal an end of corrective phase.

Res: 1.2866; 1.2904; 1.2931; 1.2974

Sup: 1.2801; 1.2750; 1.2720; 1.2673