Crude oil – rising demand and concerns about supply continue to boost the price

WTI oil price rose further and hit the highest in two weeks on Wednesday, as larger than expected draw in US crude inventories (API report) point to increased demand, while a hurricane in the Gulf of Mexico raises concerns about supply.

The oil prices were additionally supported by signals that Saudi Arabia is likely to extend its voluntary production cut, to keep oil supply tight.

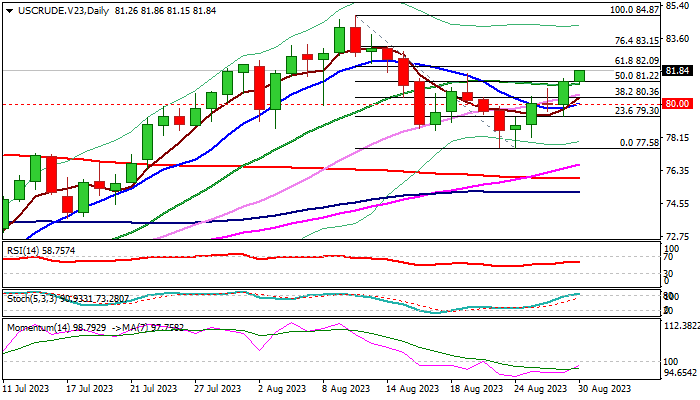

Recovery from $77.58 (Aug 24 low) has so far retraced between 50% and 61.8% of $84.87/$77.58 bear-leg, confirming a higher low at $77.58 (Aug 23/24 lows), as well as a bear-trap under $78.05 Fibo support, on daily chart.

Daily structure is improving, although 14-d momentum is still in negative territory and stochastic entered overbought zone, which may cause headwinds.

Fresh bullish signal to be expected on firm break of $82.09 (Fibo 61.8% of $84.87/$77.58) which would spark acceleration towards $83.15 (Fibo 76.4%).

Dips should hold above $81.00 zone to keep fresh bulls intact and guard lower pivots at $80.00 (psychological support) and $79.67 (weekly cloud base).

Res: 82.09; 82.89; 83.15; 83.80

Sup: 81.13; 80.66; 80.00; 79.35