Gold under pressure from strong dollar, attack at $1900 likely after consolidation

Gold price fell to ten-day low on Tuesday, under increased pressure from rising dollar which is trading at the highest in ten months.

Fed’s narrative about one more rate hike towards the end of the year and signals that the central bank is likely to keep high rates for some time, until inflation returns to 2% target, keeps the greenback inflated and reducing demand for non-yielding yellow metal.

Traders focus on Friday’s released of US key consumer inflation report (PCE), Fed’s preferred inflation gauge, with stronger than expected data to add to downside pressure on gold.

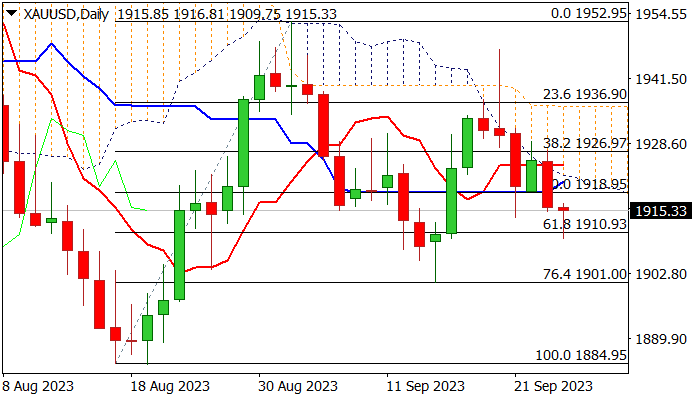

Technical picture on daily chart is still unclear as MA’s are in full bearish setup but 14-d momentum is touching the line dividing positive and negative territory and stochastic is oversold.

Fresh bears faced headwinds at $1910 support (Fibo 61.8% of $1884/$1952 upleg), which guards pivotal support at $1900 (Fibo 76.4% Sep 14 spike low / psychological).

Immediate bears are expected to remain intact while the action holds below broken Fibo 50% level ($1918), though larger bias should stay negative while the base of daily Ichimoku cloud ($1922) caps.

Res: 1918; 1922; 1929; 1936

Sup: 1910; 1904; 1900; 1889