Dollar regains traction on higher than expected US inflation in September

The dollar advanced across the board on Thursday after inflation in US rose above expectations in September, adding to prospects that the Federal Reserve may keep high interest rates for some time.

US consumer prices increased by 0.4%, beating consensus at 0.3% while annualized inflation stayed unchanged at 3.7% in September, but above 3.6% forecast.

Higher gasoline prices were the main driver of inflation last month, as core inflation, excluding volatile food and energy items, stayed unchanged at 0.3% (m/m) while annualized core CPI dipped to 4.1% from 4.3% previous month, confirming that underlying inflation remains in the downward trajectory.

However, overall situation remains fragile, as high borrowing cost started to bite and eventually impacted the labor sector which was in quite good shape until now.

The US policymakers softened their narrative in the most recent comments, signaling that the central bank was done with rate hikes, though leaving the door opened for possible another 25 basis points hike by the end of the year, but any decision to be driven by economic data.

The Fed members think that current policy is sufficient to bring inflation back to 2% target, supporting their view by the fact that US interest rate is higher than level of inflation.

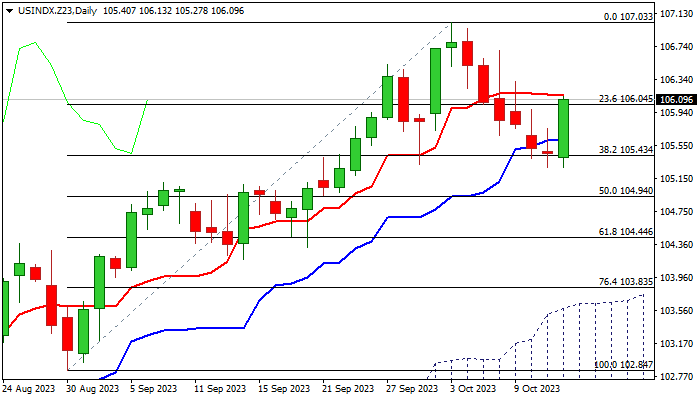

Today’s market reaction signals that traders see a higher for longer scenario as the most likely, as the dollar index advanced 0.3% after release of CPI data and retraced nearly half of the latest 107.03/105.28 pullback, adding to growing signals that corrective phase might be over.

Technical studies returned to full bullish setup on daily chart, although fresh strength needs to clear pivotal barriers at 106.36/46 (Fibo 61.8% of 107.03/105.28 / broken bull-trendline off July 18 low at 99.20) to confirm reversal and bring larger bulls fully in play.

Fresh advance should register daily close above 106 today, to keep bullish bias.

Res: 106.15; 106.36; 106.46; 106.69

Sup: 105.95; 105.70; 105.28; 104.94