Deepening crisis in the Middle East lifts gold price to one-month high

Gold rose to the highest in almost one month on Wednesday morning, signaling bullish continuation after larger rally paused for consolidation in past two days.

Overall environment remains favorable for safe haven bullion which advanced around $100 since the conflict in the Middle East started and shows signs for further gains as the situation is deteriorating.

The latest tragedy on deadly blast in Gaza hospital which took a hundreds of lives, adds to already overheated situation and threatening of further escalation of conflict, which continues to prompt traders into safety.

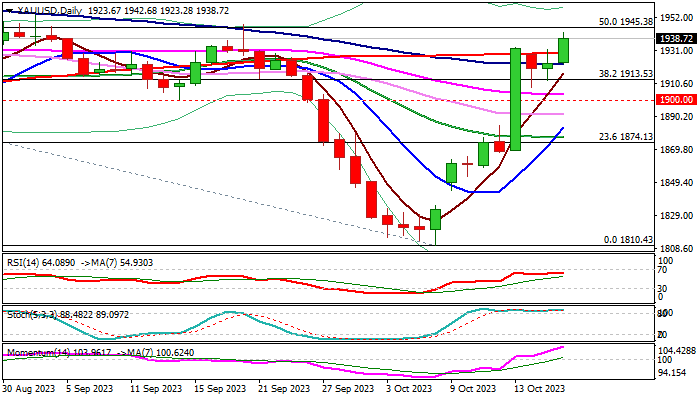

Steep uptrend from $1810 (Oct 6 low) is on track to fully retrace $1947/$1810 bear-leg and also retraced nearly 50% of larger downtrend from new record high at $2080 (May 4).

Daily close above broken 200DMA ($1929) is seen as minimum requirement to keep bulls intact for attack at pivotal $1945/52 zone (50% of $2080/$1810 / Sep 1 spike high), break of which to unmask next targets at $1977 / 87 (Fibo 61.8% / July 20 top).

Overbought daily studies require caution, though near-term bias is expected to remain with bulls while the action holds above broken Fibo barrier at $1913 (38.2% of $2080/$1810).

Res: 1945; 1952; 1972; 1977

Sup: 1929; 1922; 1913; 1908