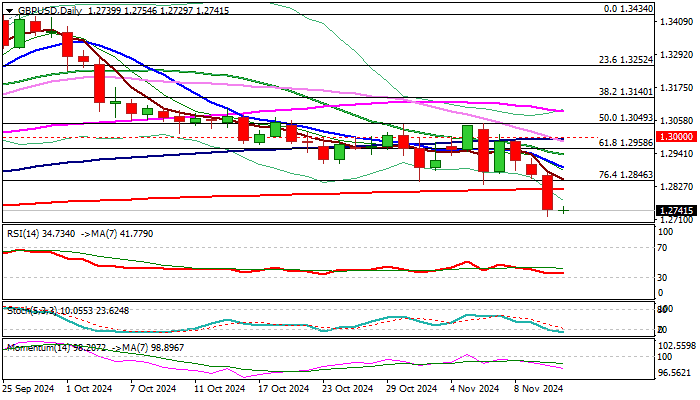

GBPUSD – bears take a breather after sharp three-day fall; broken 200DMA reverts to solid resistance

Cable is holding within a narrow consolidation in early Wednesday’s trading as bears started to run out of steam after steep fall (down 1.85%) in past three days.

Tuesday’s break and close well below pivotal supports at 1.2846 (Fibo 76.4% of 1.2664/1.3434 / former base) and 1.2817 (200DMA) generated strong bearish signal.

Markets await release of US inflation data for October (due later today) for fresh signals that keeps the pair in a quiet mode this morning.

Broken 200DMA / Fibo reverted to resistances which should ideally cap upticks to keep larger bears intact and guard falling 10DMA (1.2894) and 20DMA (1.2938) violation of which would question bears and risk test of upper breakpoint at 1.3000 (psychological / 100DMA).

Res: 1.2776; 1.2817; 1.2846; 1.2894

Sup: 1.2719; 1.2664; 1.2612; 1.2599