Bears on hold after strong acceleration on Thursday; weak NFP could further pressure the greenback

The pair is consolidating within tight range above new three-week low on Friday, following Thursday’s 1.07% drop (the biggest one-day fall since August.

The greenback was hit by dovish Fed and yen appreciated from unchanged BoJ but Japanese currency accelerated strongly on China’s doubts about the possibility of reaching deal with the US that sparked strong safe-haven demand.

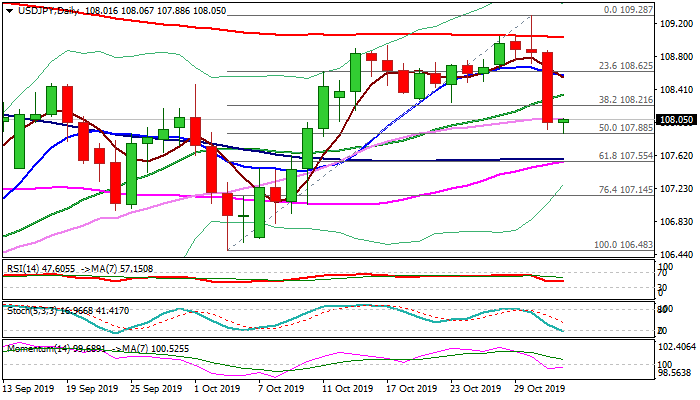

Reversal pattern has formed on daily chart after Thursday’s drop, which hit 50% retracement of 106.48/109.28 upleg / daily Kijun-sen and closed below 20 and 30 DMA’s (108.34/06 respectively).

Bearish daily momentum adds to negative sentiment, keeping near-term bias with bears for extension towards key Fibo support at 107.55 (61.8%) reinforced by converged 100/55 DMA’s.

Traders focus on today’s key event – US Non-Farm payrolls data fresh signals.

US jobs report is expected to show slowdown (NFP Oct 89K f/c vs Sep 136K / Unemployment Oct 3.6% f/c vs 3.5% in Sep) and would raise concerns about the health of the US economy.

On the other side, earnings are expected to rise (Oct 3.0% f/c vs 2.9% prev) and may offset negative impact.

The dollar is likely to react negatively if jobs data disappoint, while upbeat number would provide some relief, however, negative sentiment over renewed trade pessimism may limit positive reaction.

Daily Tenkan-sen (108.58) marks upper pivot) and only close above would sideline downside risk.

Res: 108.14; 108.25; 108.58; 108.87

Sup: 107.88; 107.55; 107.43; 107.09