Euro returned to strength after short-lived dip on solid US jobs data

The Euro initially fell to daily low (1.1128) after solid US jobs data (Oct NFP 128K vs 89K f/c) with strong upwards revision of Sep figure (180K from 136K) which diminished worries about negative signals from weak forecasts.

Although monthly earnings fell below expectations (Oct 0.2% vs 0.3% f/c) annualized figure remained unchanged (3.0%) and added to positive tone.

However, the pair regained traction after 10 DMA (1.1128) contained dip and fresh strength emerged on weaker than expected US ISM Manufacturing PMI (Oct 48.3 vs 48.9 f/c).

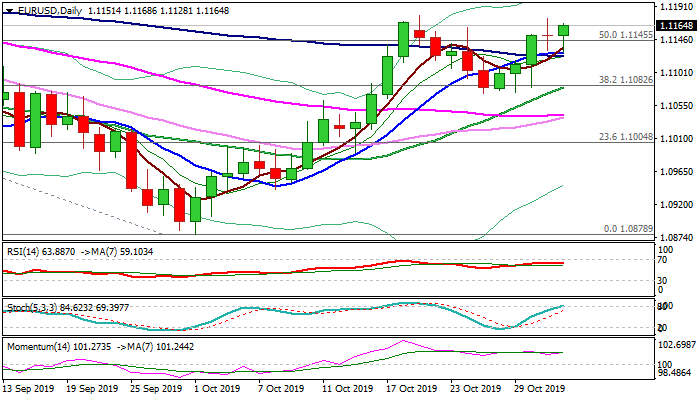

European session high (1.1168) was retested, with near-term bias remaining with bulls and keeping in focus key barriers at 1.1200 zone – 200DMA (1.1196) and Fibo 61.8% of 1.1412/1.0878 (1.1208), violation of which would be bullish signal.

Bullish engulfing pattern is forming on daily chart and adding to positive tone.

Res: 1.1168; 1.1179; 1.1196; 1.1208

Sup: 1.1145; 1.1128; 1.1093; 1.1073