Euro eases ahead of Lagarde but bias remains with bulls

The Euro dipped in early European trading on Monday as traders await the first speech of Christine Lagarde as ECB’s president, later today.

Lagarde is widely expected to continue the easy policy of her predecessor Mario Draghi.

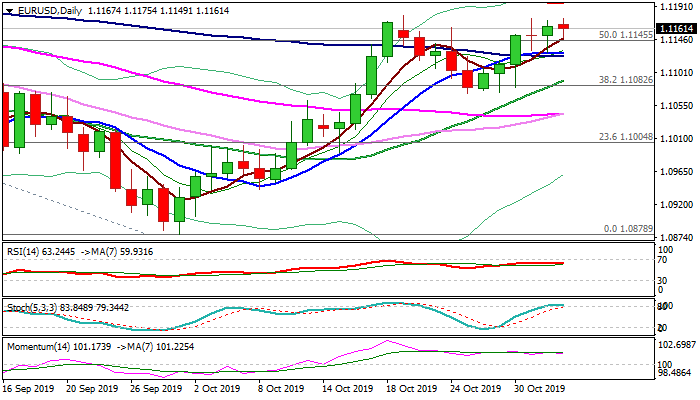

The single currency failed again at strong 1.1175 resistance zone (last week’s double rejection and 21 Oct high at 1.1179) showing hesitation on approach to key barriers at 1.1195 (200DMA) and 1.1208 (Fibo 61.8% of 1.1412/1.0878).

However, the pair maintains bullish bias, inflated by hopes that the US may not impose tariffs on car imports, with weekly bullish engulfing pattern supporting positive stance.

Strong downside rejections at 10DMA (1.1128) last Thu/Fri suggest that bulls remain in play.

Flat daily momentum and overbought stochastic, warn of further sideways trading, but bullish bias will remain unharmed while 10DMA holds.

Better than expected results of Manufacturing PMI’s from Germany, France, Italy and EU, released this morning, add to positive tone.

Bullish scenario remains favored for now and requires firm break of 1.1195/1.1208 pivots to signal continuation of bull-phase from 1.0878 towards targets at 1.1285 (mid-July highs / Fibo 76.4%).

Caution on break and close below 10DMA which would generate initial bearish signal and expose key supports at 1.1073/64 (late Oct higher base / Fibo 38.2% of 1.0878/1.1179 ascend), loss of which will be bearish.

Res: 1.1179; 1.1195; 1.1208; 1.1285

Sup: 1.1149; 1.1128; 1.1108; 1.1073