Another build in US crude stocks pressures oil price further

WTI oil extends weakness into second straight day and cracked $39 support after release of US crude stocks data on Thursday.

The oil price falls further as bulls stalled after hitting new 3 ½ month high ($41.61) on Tuesday.

Rising concerns that the second wave of coronavirus would hurt global demand again, pressured oil prices.

In addition, crude inventories reports (API on Tuesday and EIA today) further soured sentiment as data showed that crude stocks rose for the third consecutive week.

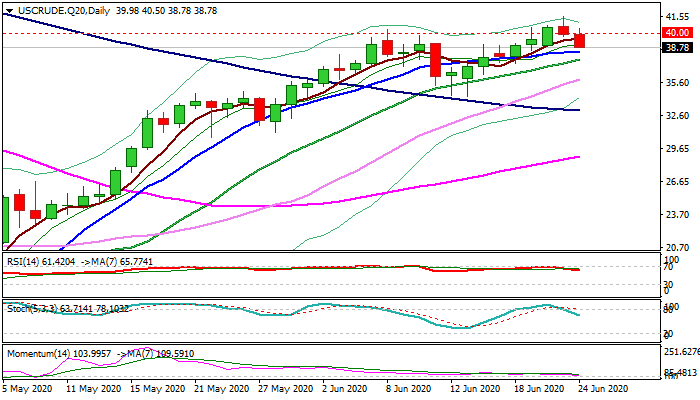

Reversal pattern is forming on daily chart and completion would require today’s close in red that would open way for further easing on taking profits after bulls failed to clearly break psychological $40 barrier on first attempt.

Fading bullish momentum and south-heading stochastic on daily chart add to negative signals.

Extension though pivotal supports provided by converging 10/20DMA’s ($38.35/$37.67) would generate stronger reversal signals.

Extended pullback needs to hold above $34.33 (15 June trough) to keep larger bulls in play.

Res: 40.00; 40.41; 40.74; 41.00

Sup: 38.35; 38.00; 37.67; 36.35