Approaching Hurricane in the US and concerns about the impact of sanctions on Iran keep oil prices well supported

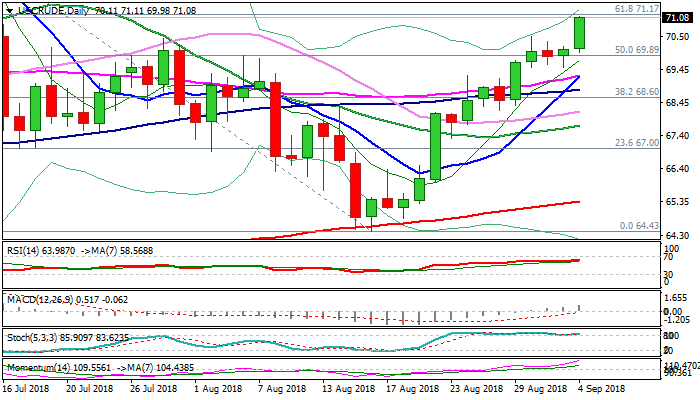

WTI oil accelerated higher on Tuesday, signaling continuation of broader uptrend after completion of three-day consolidation, which formed bullish pennant on daily chart.

Preparations for coming hurricane in the Gulf of Mexico, which resulted in closure of some oil platforms, boosted oil prices.

Also, expectations of lower production in Iran, due to US sanctions, adds to bullish outlook.

Fresh advance pressures pivotal barrier at $71.17 (Fibo 61.8% of $75.34/$64.43 descend), break of which is needed for another bullish signal.

Firmly bullish daily techs support scenario, with supports at $70.42/00 (former high / psychological support) expected to ideally contain dips and keep the downside protected.

Focus turns towards US weekly crude stocks reports (API report is due on Wednesday and EIA will release their crude inventories report on Thursday) with both reports being delayed one day due to US closure for Labor day holiday on Monday.

Res: 71.17; 71.64; 72.00; 72.77

Sup: 70.42; 70.00; 69.52; 69.27