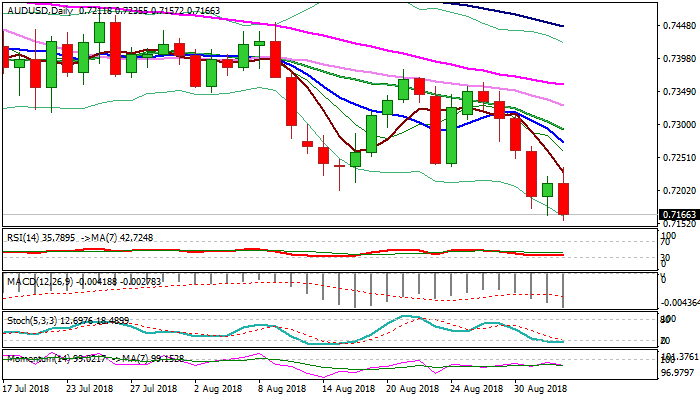

Fresh weakness after short-lived post-RBA rally retests key 0.7160 support zone

Post-RBA short squeeze was short-lived as the Aussie peaked at 0.7235, before falling sharply and posting new low at 0.7157 on renewed probe through key 0.7160 support zone (May/Dec 2016 / Jan 2017 lows).

Australian central bank kept interest rates unchanged at all time low at 1.5% in its September’s meeting and signaled a steady policy ahead. Bullish signal that the economy has grown above trend rate in the first half of 2018, was not enough to further support the Aussie dollar.

Limited recovery attempts were capped by falling 5SMA, with subsequent weakness reflecting the overall negative tone.

Clear break below 0.7160 base is needed to generate strong bearish signal for extension of broader downtrend from 2018 high at 0.8135, towards psychological 0.7000 support and 0.6906 (03 Sep 2015 low), with further weakness to unmask key longer-term support at 0.6825 (15 Jan 2016 low).

Meanwhile, bears may show further hesitation at key 0.7160 support zone on oversold daily studies.

Res: 0.7202; 0.7240; 0.7273; 0.7292

Sup: 0.7157; 0.7100; 0.7000; 0.6906