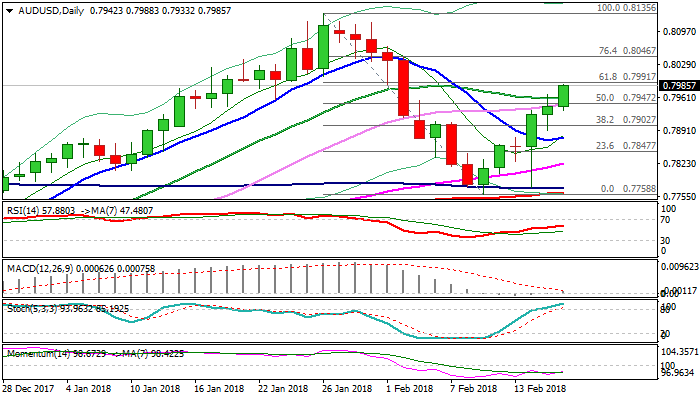

AUDUSD – extension of recovery pressures pivotal 0.80 resistance zone

The Australian dollar rose to new two-week high on Friday in extension of recovery rally from 0.7758 (09 Feb low).

Broader weakness of US dollar drives the Aussie higher to pressure pivotal 0.80 resistance zone (Fibo 61.8% of 0.8135/0.7758 pullback / psychological barrier), break of which would generate strong bullish signal.

The Aussie showed mild reaction on remarks from RBA Governor Lowe late Thursday. Lowe said that the central bank doesn’t see case for increasing interest rates soon as high unemployment and low inflation would keep interest rates at record lows until situation improves.

Positive setup of daily techs is supportive and firm break above 0.80 pivotal zone would open way towards 0.8046 (Fibo 76.4%) and expose key barrier at 0.8135 (26 Jan peak).

However, strongly overbought slow stochastic requires caution but no firmer bearish signal being generated so far.

Broken 20SMA offers solid support at 0.7957 with stronger dips to be contained by 10SMA which reversed higher and currently lies at 0.7876.

Res: 0.8000; 0.8046; 0.8100; 0.8135

Sup: 0.7957; 0.7933; 0.7902; 0.7876