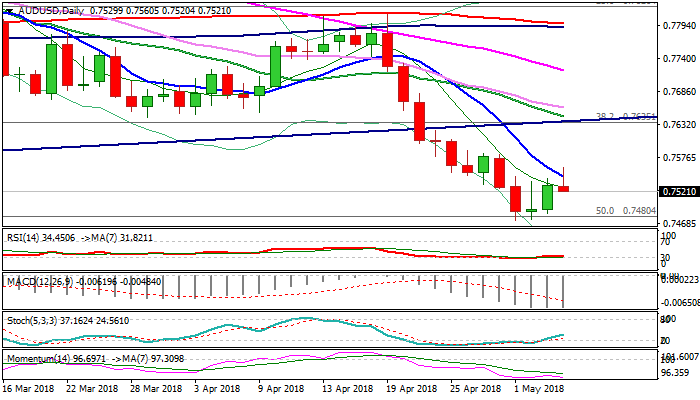

AUDUSD – falling 10SMA caps recovery attempts and keep the downside at risk

The Aussie dollar eased after failing to break above falling 10SMA (0.7546) and risks to diminish positive signal on formation of Doji reversal pattern on daily chart.

Release of RBA’s monetary policy statement showed mild impact on the Aussie, as the central bank pointed on faster growth but slow inflation, signaling that interest rates would remain at record lows for some time.

Downside is expected to remain at risk while falling 10SMA caps as strong bearish momentum adds to bearish pressure.

Weekly close below cracked 0.75 higher base to confirm negative scenario and open way for further weakness.

Immediate bears could be sidelined on close above 10SMA, however, reversal confirmation requires break and close above 0.7602 (Fibo 38.2% of 0.7812/0.7472 bear-leg).

Res: 0.7546; 0.7560; 0.7583; 0.7602

Sup: 0.7521; 0.7482; 0.7472; 0.7456