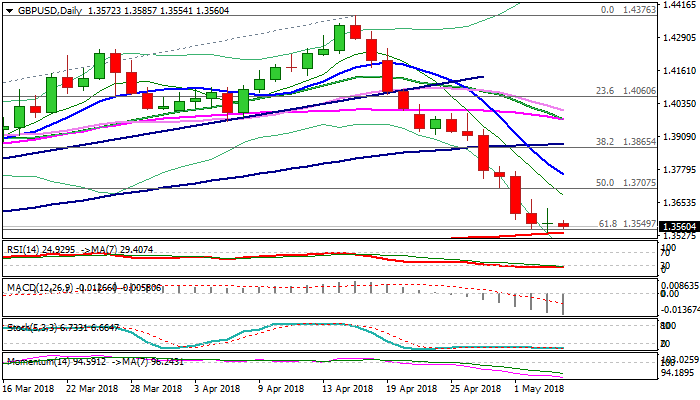

GBPUSD – 200SMA holds and Thursday’s Doji signals indecision but no firmer bullish signals for now

Cable holds in tight consolidation range in early Friday’s trading after 200SMA contained steep fall from 1.4376 and Thursday’s long-legged Doji showed signs of indecision.

Daily MA’s are in firm bearish setup and formed a number of bear-crosses, while 14-d momentum continues to trend lower, deeply in negative territory, maintaining strong pressure for eventual break through 200SMA pivot.

On the other side, oversold daily RSI and slow stochastic so far did not generate stronger bullish signal which could boost recovery.

Bears need clear break below cracked Fibo support at 1.3550 (Fibo 61.8% of 1.3038/1.4376) and 1.3535 (200SMA) to signal continuation of downtrend from 1.4376.

Alternative scenario requires strong bullish close on Friday to complete Doji reversal pattern on daily chart and generate bullish signal for stronger recovery.

US jobs data are expected to give more clues about pair’s near-term direction.

Res: 1.3605; 1.3629; 1.3665; 1.3711

Sup: 1.3550; 1.3535; 1.3500; 1.3442