AUDUSD on track for a weekly loss of over 2%

AUDUSD remains firmly in red for the fifth straight day and on track for a weekly loss of over 2% which erased the most of previous week’s gains.

Aussie came under increased pressure from the Fed’s latest hawkish shift, which so far offsets renewed hawkishness from the RBA on growing fears that inflation will remain resilient, indicating possible further rate hikes.

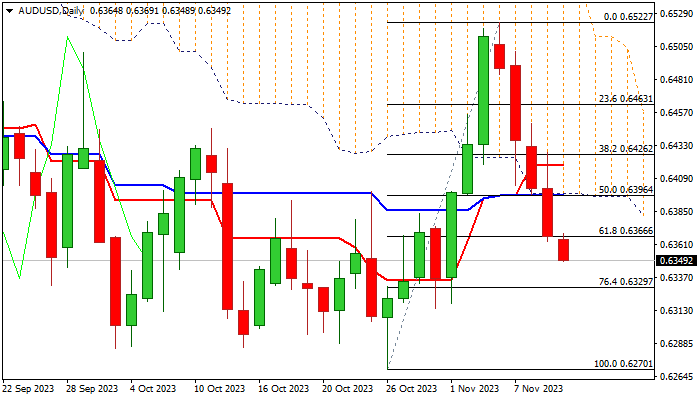

Technical picture on daily chart weakened significantly as the price broke below thick daily cloud and MA’s turned to bearish setup, while 14-d momentum is trending lower but still holding in positive territory.

On the other hand, deeply oversold stochastic may slow bears for consolidation which should offer better selling opportunities if limited and keeping bears intact.

Initial resistance lays at 0.6366 (broken Fibo 61.8% / 20DMA), with extended upticks to stay below 0.6396 (daily cloud base / daily Kijun-sen)) and maintain bearish bias.

Res: 0.6366; 0.6396; 0.6408; 0.6426

Sup: 0.6329; 0.6314; 0.6285; 0.6270