Dollar Index – bulls are taking breather after acceleration on hawkish Fed

Bulls are taking a breather after four-day recovery which accelerated on Thursday on hawkish comments from Fed Chair Jerome Powell.

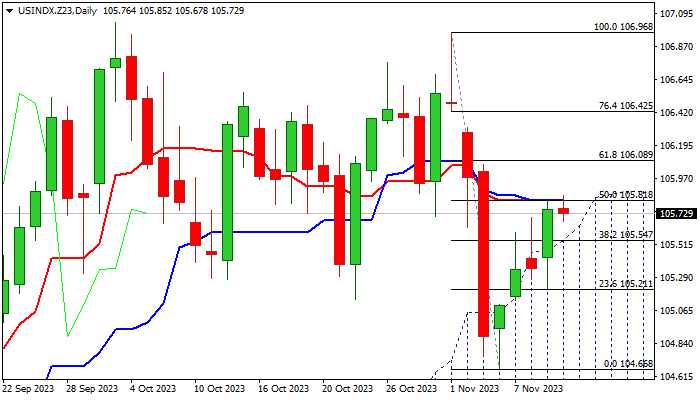

Fresh advance faced headwinds from significant barrier at 105.81 (50% retracement of 106.96/104.66 bear-leg / converged daily Tenkan/Kijun-sen) but bulls hold grip as north-heading 14-d momentum emerged into positive territory and near-term action remains underpinned by rising thick daily Ichimoku cloud.

Bullish bias expected to remain intact while the price stays above 105.64/54 pivots (daily cloud top / broken Fibo 38.2%), with break through pivotal resistances at 105.81/106.08 (Fibo 50% / 61.8%) to generate signal of bullish continuation and open way for further retracement of 106.96/104.66 pullback.

The dollar index is on track for bullish weekly close after last week’s strong fall, which adds to signals that corrective phase might be over.

Only close below 105.64/54 would sideline bulls and keep the downside more vulnerable.

Res: 104.81; 106.08; 106.42; 106.76

Sup: 105.64; 105.54; 105.22; 104.66