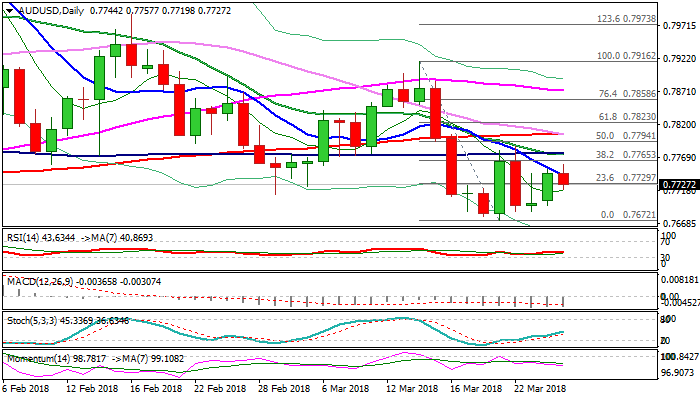

AUDUSD – recovery attempts show signs of stall as falling 10SMA caps

The Aussie dollar moved lower after hitting marginally higher recovery high at 0.7757 in early Asian trading, unable to sustain probes above falling 10SMA (currently at 0.7740).

The pair returned to negative tone in early Tuesday’s trading, despite strong recovery on Monday, showing no significant reaction to renewed risk sentiment in the markets on fading fears on global trade war.

Limited recovery of base metals weighs on Aussie along with firmly bearish daily techs ( formation of 20/100SMA bear-cross and Monday and today’s formation of 30/200 SMA death-cross increases bearish pressure) and failure at initial 10SMA barrier keeping the downside at risk.

Return to last week’s low at 0.7672 would be likely near-term scenario while falling 10SMA caps.

Conversely, bullish scenario sees break above 10SMA as initial requirement, with extension above 0.7765/76 (Fibo 38.2% of 0.7916/0.7672 / 100SMA), needed to confirm and signal stronger recovery of 0.7916/0.7672 bear-leg.

Res: 0.7740; 0.7757; 0.7775; 0.7805

Sup: 0.7720; 0.7686; 0.7672; 0.7641