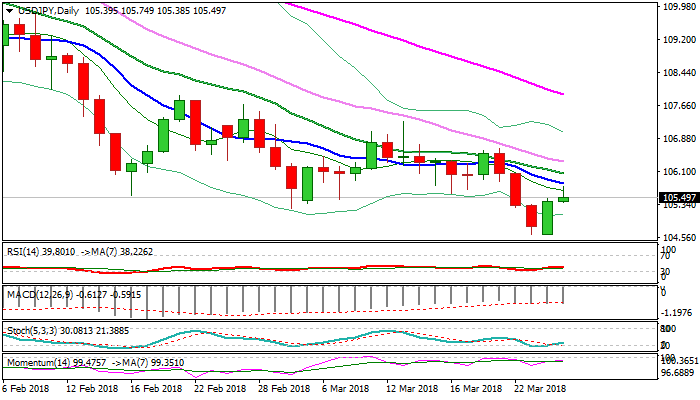

USDJPY – bullish outside day signals further recovery but falling MA’s continue to weigh

The pair ticked higher in extension of strong bounce on Monday and hit session high at 105.75, helped by fresh risk sentiment.

Recovery approaches initial barriers at 105.83/87 (falling 10SMA / Fibo 61.8% of 106.64/104.63), with downside risk fading and signaling further upside on break above 10SMA pivot.

Monday’s rally formed bullish outside day which supports scenario, however overall structure remains firmly bearish sees risk of recovery stall which would mark current action as consolidative before broader bears resume.

Plethora of barriers provided by falling MA’s (10/20/30 SMA) lies between 105.83 and 106.33 and marks pivotal zone, break of which is required to neutralize persisting downside threats and trigger stronger recovery.

Res: 105.83; 106.05; 106.33; 106.64

Sup: 105.38; 105.24; 105.00; 104.63