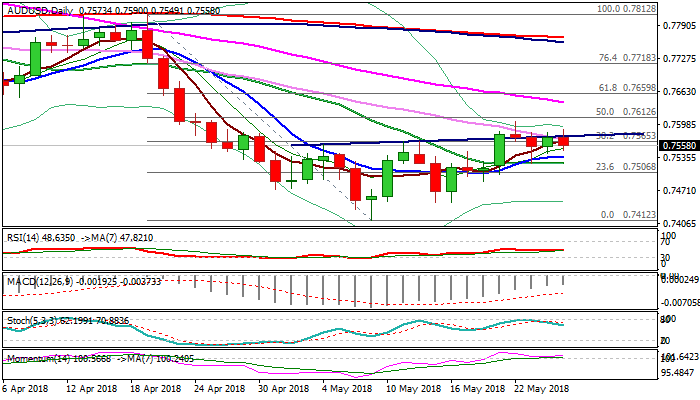

AUDUSD – strong signals of recovery stall on weekly close below falling 30SMA

The Aussie dollar erased all gains from the morning (peaked at 0.7590) on fresh acceleration lower in early hours of the US session.

Upside attempts stalled again, signaling another failure to clearly break falling 30SMA (0.7569) and the neckline of inverse H&S pattern on daily chart (0.7575).

Fresh weakness brings initial pivot at 0.7536 (sideways-moving 10SMA) in focus, as slow stochastic turned south and flat momentum support negative scenario.

Softer commodities and equities and stronger yen soured Aussie’s near-term tone, with firmer signals that recovery struggles could be expected on repeated close below falling 30SMA, which caps the action for the fourth straight day.

Stronger bearish acceleration and violation of pivotal supports at 0.7536 /22 (10 / 20SMA, also Fibo 38.2% of 0.7412/0.7605 recovery) would confirm bearish bias and signal formation of lower top (0.7506).

Res: 0.7590; 0.7605; 0.7642; 0.7660

Sup: 0.7549; 0.7536; 0.7522; 0.7502