Aussie bounces on weaker greenback after downbeat US jobs data

The Australian dollar bounced from session low at 0.6813, posted after Aussie’s fall on weaker than expected Australia’s GDP (Q3 0.4% vs 0.5% f/c).

The pair was inflated by renewed optimism over US/China trade talks(after President Trump said on Tuesday that the deal could prolonged until November 2020) and downbeat US private sector jobs report (ADP Nov 67K vs 140K f/c), which also fuel hopes for Fed rate cut.

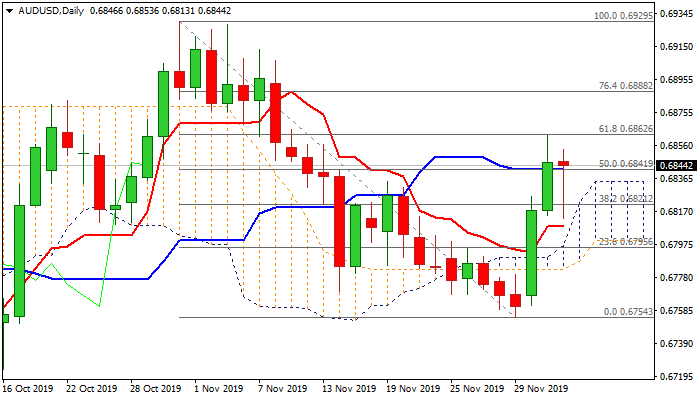

Today’s dip was contained above the top of rising daily cloud which continues to underpin near-term action (cloud top currently lays at 0.6822).

Fresh advance returned above broken daily Kijun-sen and looking for repeated daily close above, to confirm bullish signal and open way for retest of key Fibo barrier at 0.6862 (61.8% of 0.6929/0.6754).

Strong bullish momentum on daily chart supports the advance, but bulls may show hesitation on approach to 0.6862 pivot again, as daily stochastic is overbought.

Res: 0.6853; 0.6862; 0.6888; 0.6916

Sup: 0.6841; 0.6832; 0.6822; 0.6813