Aussie drops below 0.70 in extension of last week’s strong fall

The AUDUSD extends steep fall into fourth straight day and falls below 0.70 support for the first time in one month.

Risk aversion and stronger US dollar on expectations for more aggressive Fed after another red-hot inflation figure, keep the Aussie under pressure, along with signals of new Covid outbreaks in China that add to negative outlook.

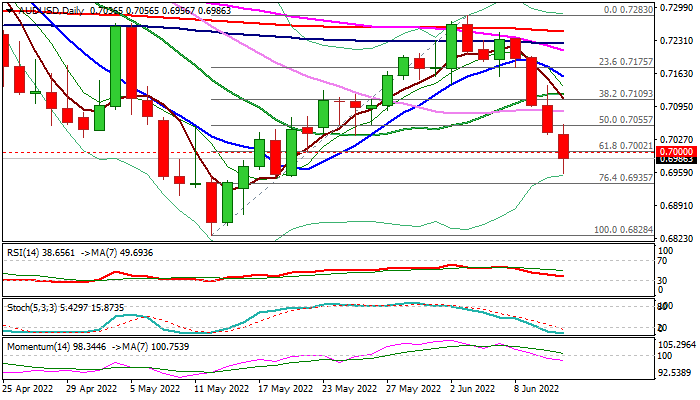

Technical studies on daily chart are in full bearish setup, with additional negative signals seen on formation of bearish engulfing on weekly chart and last week’s close below 200WMA after 2.3% weekly drop.

Bears look for a daily close below 0.70 handle to add to negative signals for probe through pivotal Fibo support at 0.6935 (76.4% of 0.6828/0.7283 upleg) that would open way for attack at 0.6828 (2022 low).

On the other side, oversold conditions warn of price adjustment before bears resume, with extended upticks expected to stay below 0.71 zone to keep bias with bears and offer better selling opportunities.

Res: 0.7055; 0.7083; 0.7109; 0.7119

Sup: 0.6956; 0.6935; 0.6872; 0.6828