Aussie extends south after recovery stalled

The Australian dollar fell further and hit new seven-week low in early Tuesday, after short-lived Monday’s recovery attempts.

Fresh strength of the US dollar after Jerome Powell got the second term as Fed Chair, further deflated

the Aussie which was down almost 4% in past three weeks, pressured by risk aversion and growing hopes for Fed’s earlier than expected rate hike.

Diverging US and Australian rate outlook, as the US is likely to make the first hike in mid-2022 while the RBA announced it may stay on hold until 2024, added pressure on Aussie dollar.

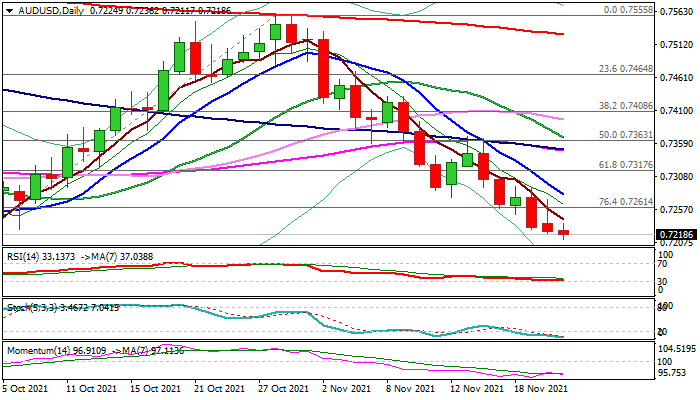

Repeated close below pivotal Fibo support at 0.7261 (76.4% of 0.7170/0.7555), which now acts as solid resistance, following Monday’s strong rejection here.

Bears pressure supports at 0.7206/0.7194 (converged 100/200WMA’s), break of which would open way towards key support at 0.7170 (Sep 29 low).

Bearish daily studies support the action, with upticks on oversold conditions expected to offer better selling opportunities, while holding below 0.7280/0.7317 (falling 10DMA / broken Fibo 61.8%).

Res: 0.7242; 0.7261; 0.7280; 0.7317

Sup: 0.7194; 0.7170; 0.7106; 0.7053