Gold tumbles as Powell gets the second term as Fed chair

Spot gold accelerated lower on Monday after announcement that US President Biden appointed Jerome Powell for the second term as Fed chair.

The news further inflated the greenback, already boosted by signals that the US central bank may increase a pace of stimulus tapering that would open way for earlier than expected rate hike, as surging inflation increases pressure on Fed, offsetting gold’s appeal as a main asset for hedging against inflation.

The yellow metal fell over 1% immediately after the announcement, hitting the lowest in more than two weeks.

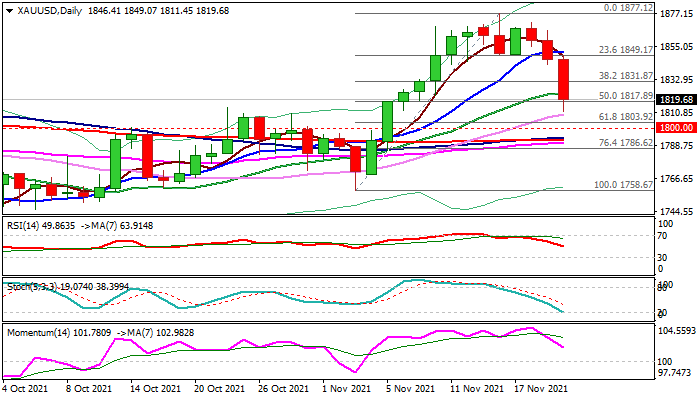

Fresh weakness boosts negative signal on completion of failure swing pattern on daily chart, confirming reversal, as the price dipped below 50% retracement of $1758/$1877 upleg.

Bears eye key supports at $1806/03/00 (weekly cloud base / Fibo 61.8% / psychological), violation of which would spark further losses and expose converged 100/200DMA’s ($1793/92).

Sharp loss of bullish momentum on daily chart supports the action, but stochastic is about to break into oversold zone that may provide headwinds and slow bears for consolidation.

Broken Fibo 38.2% ($1831) reverted to solid resistance, which should keep the upside protected.

Res: 1823; 1831; 1842; 1849

Sup: 1811; 1806; 1803; 1800