Aussie extends weakness on less dovish than expected Fed, rising expectations for RBA rate cut

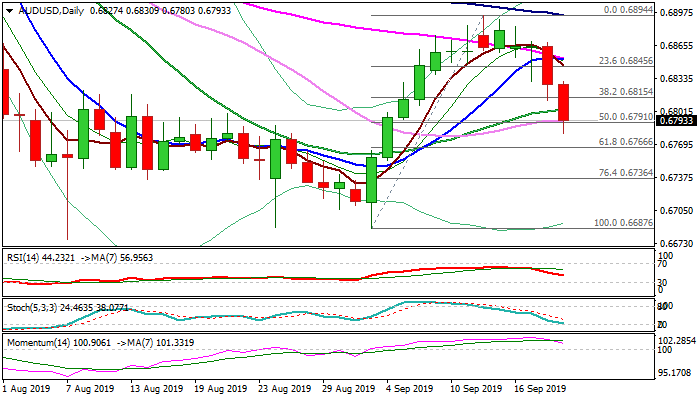

The pair stays firmly in red for the second straight day and test levels below 0.68 handle after break below daily cloud base (0.6815) generated fresh bearish signal for extension below 50% retracement of 0.6887/0.6894 recovery leg.

The pair was hit after less dovish than expected Fed, while rise in unemployment (Aug 5.3% vs July 5.2%) further soured sentiment despite better than expected employment numbers.

Additional pressure comes from rising expectations for RBA rate cut in October, as the market is currently pricing over 75% chance for such action.

Fading bullish momentum on daily chart and south-heading indicators add to negative outlook, with close below daily cloud base needs to boost negative signals test of pivotal support at 0.6766 (Fibo 61.8% of 0.6687/0.6894 and further extension lower on break.

Broken cloud base now reverted to strong resistance which is expected to keep the upside limited and maintain fresh bearish tone.

Res: 0.6803; 0.6815; 0.6830; 0.6852

Sup: 0.6780; 0.6766; 0.6736; 0.6700