Choppy directionless mode extends

The Euro regained traction and moved higher in European trading on Thursday after being hit by stronger dollar on less dovish than expected Fed on Wednesday.

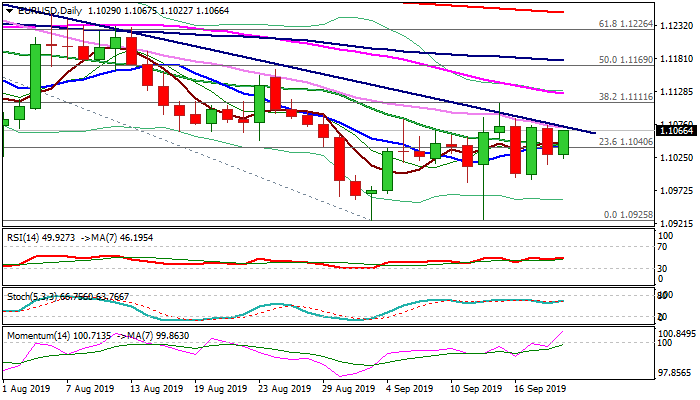

Near-term action remains within choppy and wide-range congestion which is capped by falling trendline off 1.1412 high (25 June), with the downside expected to remain vulnerable while the price stays under bear-trendline (currently at 1.1073).

Last Friday’s candle with long upper shadow, left after strong upside rejection under pivotal Fibo barrier at 1.1111 (38.2% of 1.1412/1.0926) continues to weigh, however, strong rise of bullish momentum may help fresh bulls in renewed attempt through bear-trendline and attack at 1.1111 pivot.

Firm break here is needed to confirm double-bottom (1.0926) and open way for stronger correction of 1.1412/1.0926 downtrend.

Repeated close below bear-trendline would generate initial negative signal, but return below Mon/Tue lows (1.0993/90) is needed to weaken near-term structure and re-focus 1.0926 base.

Res: 1.1073; 1.1086; 1.1111; 1.1124

Sup: 1.1040; 1.1022; 1.0990; 1.0957