Aussie maintains positive tone and pressures new multi-month high

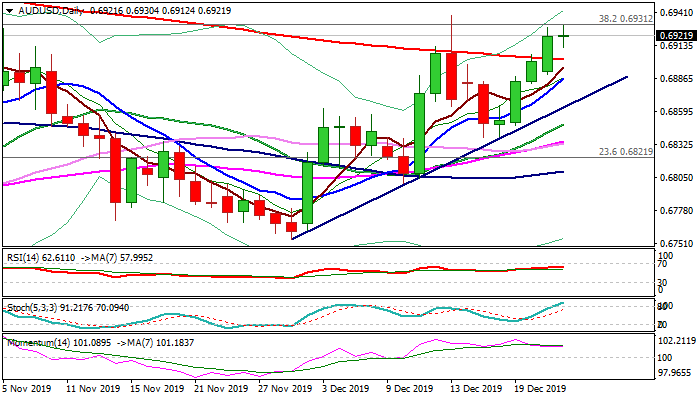

The Australian dollar remains in green on Tuesday following strong rally in past three days and eyes 4 ½ week high at 0.6938 (13 Dec), as optimism on US/China trade deal keeps the Aussie inflated.

Monday’s 0.42% daily advance resulted in break and close well above 200DMA (0.6902) and generated bullish signal.

Violation of pivotal barriers at 0.6931/38 (Fibo 38.2% of 0.7393/0.6645 / 13 Dec spike high) would open psychological 0.7000 barrier (also weekly cloud base).

Sideways-moving daily momentum / RSI and overbought stochastic suggest that bulls may take a breather before final push higher, with holiday-thinned markets also expected to contribute.

Broken 200DMA is expected to keep the downside protected and guard trendline support (0.6874).

Res: 0.6931; 0.6938; 0.6959; 0.7000

Sup: 0.6912; 0.6902; 0.6886; 0.6974