Oil remains in red but still away from key supports

WTI oil remains in red on Monday following the biggest one-day fall in past three weeks on Friday, as oil price was hurt by signs that US shale explorers intensify drilling and Kuwait’s attempts to reach a deal with Saudi Arabia and restore oil production along the border between two countries.

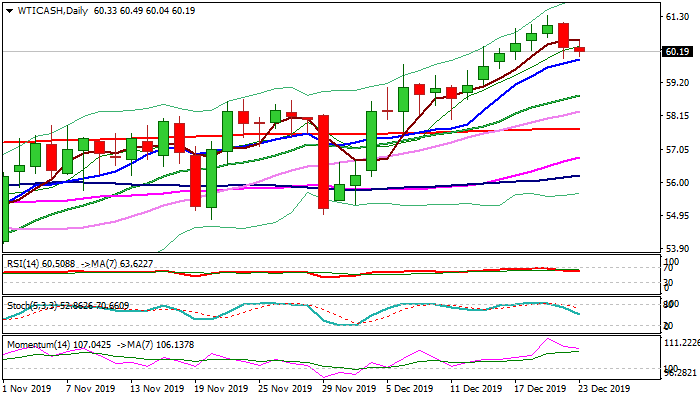

Dips were so far limited, keeping pivotal supports at $60/$59.93 (psychological / rising 10DMA) and $59.70/67 (weekly cloud top / daily Tenkan-sen) intact.

Repeated close above rising 10DMA would ease downside risk, as overall sentiment is bullish and boosted by expectations that US/China phase1 trade deal will be signed soon.

Also, holiday-thinned markets could contribute to narrower ranges an lack of direction.

The only scheduled event which could move oil prices is late Tuesday’s release of API crude stocks.

Res: 60.49; 60.64; 61.12; 61.33

Sup: 60.00; 59.93; 59.67; 59.15