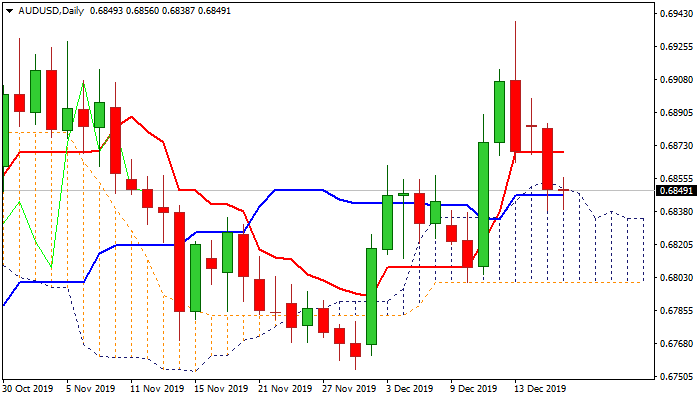

Aussie remains heavy after bears penetrated thick daily cloud

The Australian dollar is consolidating Tuesday’s 0.5% fall but remains in negative mode as dollar remains inflated by fresh weakness of sterling and dovish tone on RBA minutes on Tuesday.

Tuesday’s penetration of thick daily cloud and marginal close below cloud top was bearish signal, reinforced by retracement of 50% of 0.6754/0.6938 rally.

Fading bullish momentum on daily chart and bearishly aligned stochastic / RSI add to negative signals which require confirmation on repeated close within daily cloud, to open way towards key support levels at 0.6824 (Fibo 61.8%, reinforced by converged 20/30/55DMA’s) and 0.6800 (daily cloud base.

Upticks should stay capped by broken daily Tenkan-sen (0.6869) to keep bears in play.

Res: 0.6856; 0.6869; 0.6884; 0.6897

Sup: 0.6846; 0.6838; 0.6824; 0.6800