Oil price eases but key supports still intact; crude inventories report eyed for fresh signals

WTI oil price eased from new three-month high at $60.93 on Wednesday, after Tuesday’s API report showed unexpected rise in crude stockpiles (4.7 million barrels vs last week’s build of 1.4 million barells).

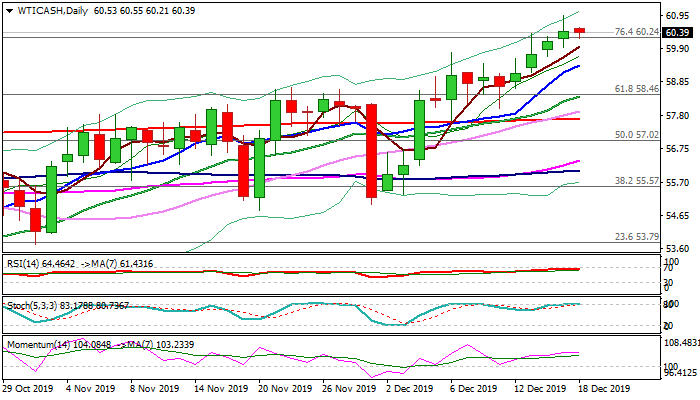

Dips were so far contained by broken Fibo 76.4% barrier at $60.24) which guards more significant psychological $60 support and weekly cloud top at $59.70).

Oil prices remain supported by US/China phase one trade deal and recent positive data from China, but concerns about global oversupply despite OPEC’s decision to increase production may obstruct bulls.

Daily studies are bullish but overbought stochastic warns of consolidation / pullback.

Markets focus today’s release of EIA weekly crude inventories report, due later today.

Forecast is for a draw in crude stocks by 1.2 million barrels and release in line or below the expectations would further inflate oil price.

On the other side, oil price may come under increased pressure if crude stocks unexpectedly rise.

Bullish bias is expected to remain while supports at $60.00/$59.70 hold, while break and close below would soften near-term tone and risk deeper pullback.

Res: 60.55; 60.93; 61.50; 62.00

Sup: 60.24; 60.00; 59.70; 59.28