Australian dollar edges lower on weaker than expected China’s economic data

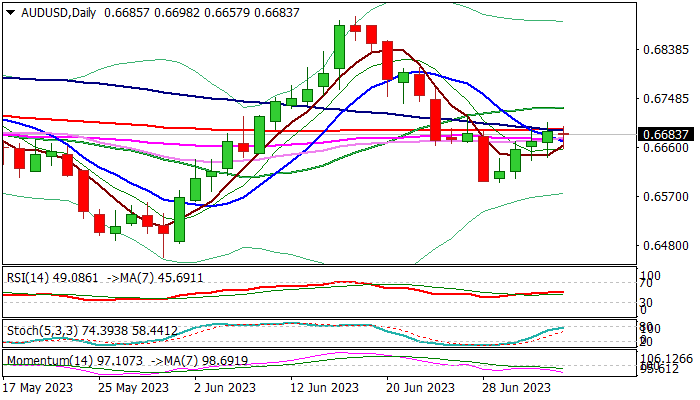

Australian dollar turned to red on Wednesday, generating initial signal that the upleg from 0.6595 (June 29 higher low) might be running out of steam.

Four-day recovery leg faced strong headwinds at 0.6690 zone (double bear-cross of 10/200 and 100/200DMA’s), with fresh weakness on Wednesday, warning of stall.

The Aussie dollar was deflated by weaker than expected China’s PMI data (Caixin services PMI fell to 53.9 in June, the lowest in six months, from 57.1 in May) which pressured Chinese yuan and subsequently weighed on Australian dollar, often seen as yuan’s proxy.

Fresh weakness is still holding above the top of daily Ichimoku cloud (spanned between 0.6654 and 0.6618), signaling neutral stance and likely consolidation, as long as the price action is moving between cloud top and 200DMA.

Mixed daily studies contribute to this scenario, with fresh direction signals expected on violation of either pivot (0.6654 or 0.6690).

The minutes of Fed’s last policy meeting are due later today and will be closely watched for more clues about the central bank’s interest rate path, as markets also await release of US job reports on Thursday (ADP, private sector payrolls) and Non-Farm payrolls on Friday, which will provide ore details about the health of the US labor sector.

Res: 0.6690; 0.6711; 0.6747; 0.6783

Sup: 0.6654; 0.6618; 0.6595; 0.6562