USDTRY rises further after Turkish inflation data

Turkish lira fell to new marginally lower record low in early Wednesday, as Turkish June inflation data sparked fresh weakness of the currency.

Monthly inflation rose by 3.9% in June, below 4.8% consensus and annualized figure was also below expectations (38.2% in June vs 39.4% f/c), while consumer prices were slightly below previous month’s figure (June PPI 40.4% vs May 40.7%).

Inflation remains elevated, though significantly below last October’s 85.5%, the highest in over two decades.

Turkish lira fell sharply in June (down over 20% vs US dollar, the biggest monthly fall on a record), following re-election of President Erdogan and despite CBRT’s new leadership and turn towards more orthodox approach to monetary policy, as the central bank already raised interest rates after a cycle of cutting rates last year.

Lira remains at the back foot, as sentiment is weak and the latest steps of the central bank produced no positive impact on the currency, keeping the outlook darkened.

Lira’s action is weighed by June’s massive bearish monthly candle, with strongly oversold conditions on all larger timeframes, being offset by weakening sentiment and leaving little space for consolidation.

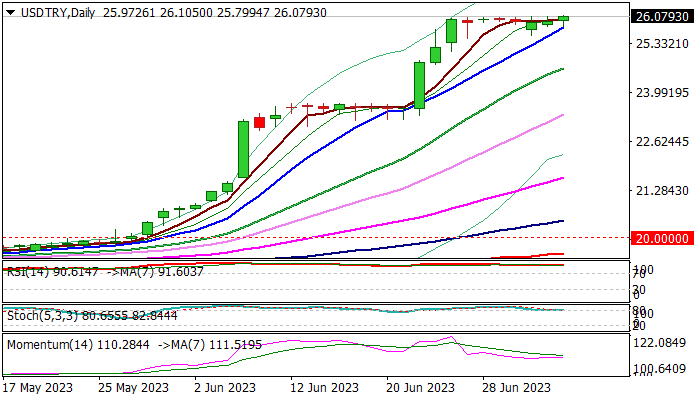

USDTRY broke above 26.00 mark and eyeing Fibo projections at 26.4966 (200%) and 29.6129 (238.2%) ahead of psychological 30.00 barrier.

Rising 10DMA offers immediate support at 25.7900, followed by the last week’s consolidation floor at 25.4668.

Res: 26.4966; 27.0000; 28.0000; 29.6129

Sup: 26.0000; 25.7900; 25.4668; 25.1158