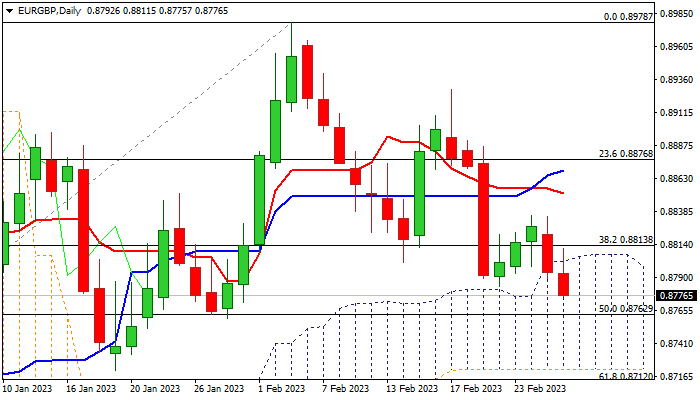

Bears accelerate and look for test of 2023 low

The cross remains firmly in red on Tuesday and extends weakness into second straight day, falling deeper into thick daily cloud (spanned between 0.8805 and 0.8722).

Fresh dip cracked initial support at 0.8783 (Feb 22 low), with firm break here to open way for test of pivotal support at 0.8760 zone (50% retracement of 0.8547/0.8978 / Jan 27/30 higher base), loss of which would risk test of key levels at 0.8721/12 (Jan low / Fibo 61.8%).

Bears also broke below the neckline of the Head and Shoulders pattern on daily chart, as daily moving averages (10/20/30/55) turned to bearish setup and 14-d momentum remains in the negative territory.

Broken daily cloud top reverted to solid resistance, which should keep the upside protected and maintain bearish near-term structure.

Res: 0.8805; 0.8835; 0.8852; 0.8869

Sup: 0.8760; 0.8721; 0.8712; 0.8661