Bears are pausing above key supports ahead of US jobs data

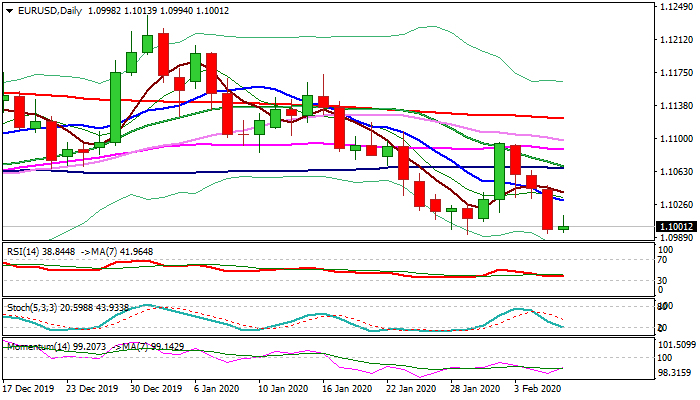

The Euro is holding within narrow consolidation just above 29 Jan multi-month low at 1.0992, which was retested on Wednesday’s strong fall.

Bears are taking a breather above key supports (1.0981/92) with larger picture being negative and favoring continuation of broader downtrend.

Downbeat German factory orders data, released earlier today, add to negative outlook as figures signal that the Europe’s largest economy hasn’t seen the worst yet.

Daily techs suggest that consolidation may extend as negative momentum is fading and stochastic entering oversold territory.

However, bears are expected to remain intact while consolidation stays below falling 10DMA (1.1030), while break here would sideline immediate bears and allow for stronger correction towards next pivotal barrier at 1.1067/68 (converging 100/20DMA’s).

US jobs data on Friday are key event and eyed for fresh signals.

The Euro may fall further if NFP comes at higher than expected figure and annualized AHE holds 3% or higher that would add to existing bright picture in the labor sector and US economy overall and offer fresh boost to the US dollar.

Res: 1.1013; 1.1030; 1.1044; 1.1068

Sup: 1.0992; 1.0981; 1.0940; 1.0925