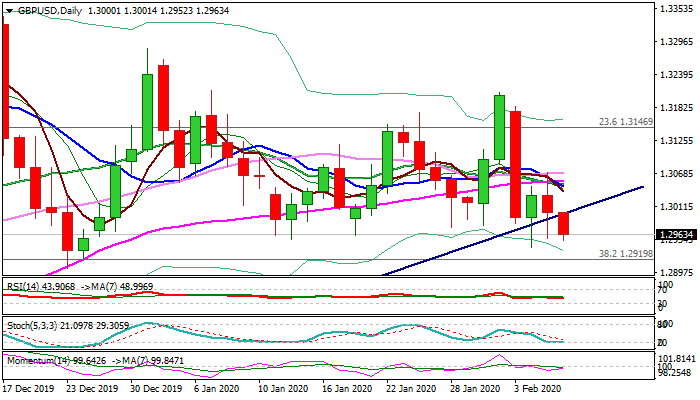

Fresh weakness emerges after two-day consolidation and turns focus towards key support zone

Cable returned to red and shifts near-term focus lower after directionless consolidative action in past two days (two daily candles with long shadows on both sides).

Fresh weakness eyes Tuesday’s low (1.2941) and key support zone at 1.2919/04 (Fibo 38.2% of 1.1958/1.3514, reinforced by rising 20WMA / 23 Dec low), break of which would generate strong bearish signal for extension of pullback from 1.3514 (2019 high) that would also hurt longs established after UK election.

Bearish daily studies add to weakening sentiment amid talks of UK Global Tariff, which Britain is planning to introduce by next year.

Broken bull-trendline (1.2998) marks initial resistance which should ideally cap and guard Fibo 38.2% barrier (1.3043) and daily Tenkan-sen (1.3075).

Res: 1.3000; 1.3043; 1.3075; 1.3107

Sup: 1.2941; 1.2919; 1.2904; 1.2880