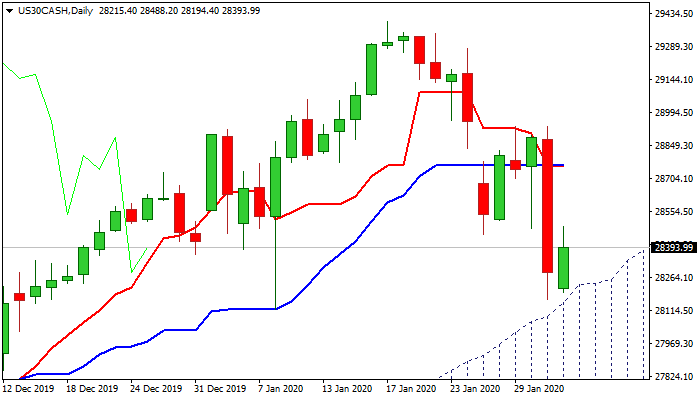

Bears are pausing above rising daily cloud

The Dow Jones bounces on Monday (up 0.77% from opening), recovering some ground after last Friday’s heavy losses (2.05% down for the day, the biggest one day fall in six months).

Fears of coronavirus spreading and rising death toll keep traders away from riskier assets that keeps Dow’s sentiment weak.

Current recovery emerged after Friday’s fall and today’s action were repeatedly contained by rising daily cloud, giving bears a breather to re-position and provide better levels for re-entry of bearish market.

Daily techs remain in bearish configuration and suggest limited recovery, which should be capped under pivotal barriers at 28636 (Fibo 38.2% of 29400/28163 pullback) to keep bears in play for renewed attack at daily cloud top (28153) and extension towards 27824 pivot (Fibo 38.2% of 25274/29400) on break.

Converged daily Tenkan-sen/Kijun-sen (28760) mark upper breakpoint and sustained break here would sideline bears.

Res: 26439; 26506; 26683; 26817

Sup: 28153; 27824; 27791; 27679