Bears are taking a breather but outlook remains negative

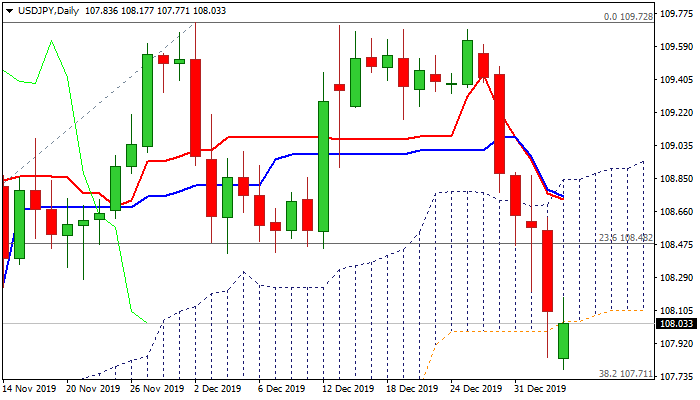

The pair is consolidating around 108 handle on Monday, despite gap-lower opening at the beginning of the week, with larger bears taking breather above important Fibo support at 107.71 (38.2% of 104.44/109.72) after last week’s 1.2% fall.

Safe-haven yen advanced strongly on deepening crisis in the Middle East and threats of escalation as the US and Iran continue to use tough rhetoric, which could keep traders away from riskier assets.

Near-term price action is holding below thick daily cloud (after last Friday’s brief probe below cloud base) with close below cloud base (108.04) to generate strong bearish signal which would require confirmation on close below 107.71 Fibo support.

Rising bearish momentum on daily chart supports scenario but is conflicted by flat stochastic and RSI (both at oversold zone boundary) suggesting extended consolidation before larger bears continue.

Daily cloud base should ideally cap and keep bears intact, but stronger upticks towards former higher base at 108.42 cannot be ruled out.

Only firm break above 200DMA (108.66) and daily cloud top (108.84) would neutralize and signal reversal.

Res: 108.04; 108.17; 108.42; 108.66

Sup: 107.77; 107.71; 107.08; 106.63