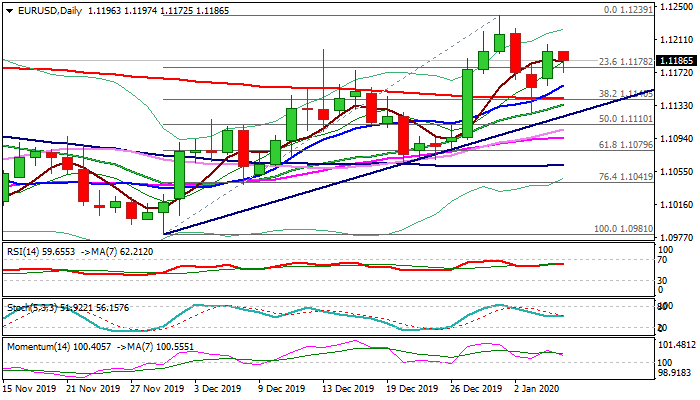

Recovery stall at pivotal 1.12 barriers but bullish bias remains while key supports hold

The Euro eases in early European trading on Tuesday after Monday’s strong recovery stalled at pivotal 1.1200 zone barriers.

Fresh bulls that emerged after strong downside rejection at key 1.1140 support last Friday, failed to generate bullish signal on close above 1.1200 zone pivots as Thursday’s long bearish candle weighs and warns of limited recovery.

Conflicting daily studies (bullish MA’s / weakening momentum / neutral RSI and stochastic) add to mixed signals, but dip-buying remains favored while supports at 1.1140/32 (200DMA / Fibo 38.2% of 1.0981/1.1239 / trendline support) hold.

EU CPI (Dec y/y 1.3% f/c vs 1.0% prev) and retail sales data (Nov m/m 0.6% f/c vs -0.6%) are top events in European session and eyed for fresh signals.

US Non-Manufacturing PMI (Dec 54.5 f/c vs 53.9 prev) will be in focus in the US session.

Res: 1.1195; 1.1205; 1.1224; 1.1239

Sup: 1.1172; 1.1156; 1.1140; 1.1132