Bears consolidate above key supports ahead of US data

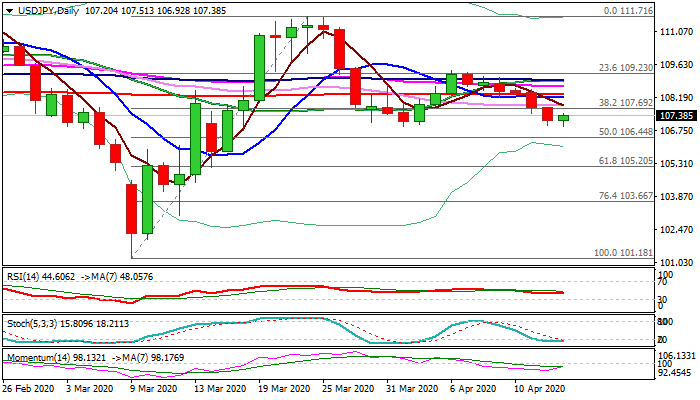

The pair bounces from 107 support zone which was cracked on Tue/Wed but without clear break so far.

Bears face headwinds from supports at 107.00 (psychological) 106.91 (1 Apr low) and 106.70 (daily cloud top) with profit-taking after four-day fall, slowing dollar’s fall.

Strong demand for safe-haven yen keeps USDJPY bears in play with consolidation likely to precede final push through 107.00/106.90 pivots.

Markets focus US retail sales data, which are expected to drop significantly due to pandemic lockdown that could increase existing pressure on dollar.

Firm break below 106.91 is needed to complete failure swing pattern on daily chart and add to negative outlook.

Broken Fibo 38.2% level (107.69) and 30DMA (107.84) mark solid resistances which should ideally cap and guard more significant 200DMA barrier (108.31).

Res: 107.51; 107.69; 107.84; 108.31

Sup: 107.00; 106.91; 106.70; 106.44