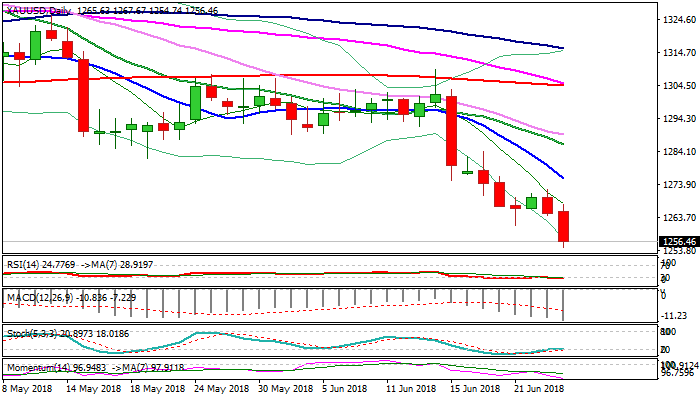

Bears could extend towards key support at $1236; falling 10SMA to cap upticks

Spot Gold holds firmly in red for the second straight day as the greenback regained traction but showed no benefits from safe haven demand on risk aversion, sparked by fears of deeper trade conflict.

The yellow metal hit new over six-month low at $1255 on Tuesday, pressuring string support at $1252 (weekly cloud base), break of which would open way towards key med-term support at $1236 (12 Dec 2017 trough).

Momentum and RSI continue to trend lower, deeply in negative territory, with bearish setup of daily MA’s, completing negative technical outlook.

Bears could take a breather before resuming higher as slow stochastic is attempting to reverse from oversold territory, but consolidation is likely to be limited.

Falling 10SMA ($1275) is expected to cap extended upticks and keep bearish structure intact.

Res: 1261; 1267; 1272; 1275

Sup: 1255; 1250; 1243; 1236