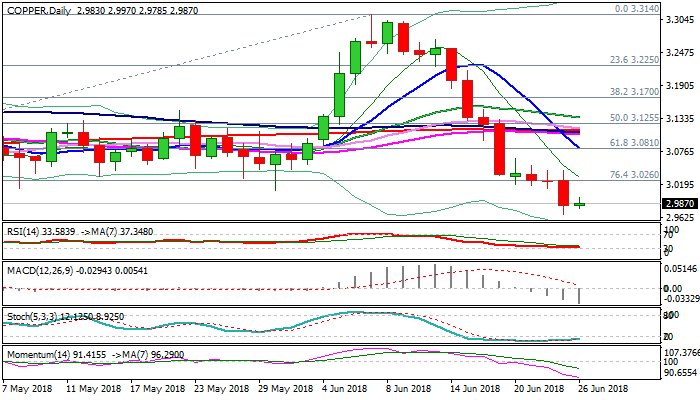

Bears look for test of key supports at $2.9425/$2.9370

Copper holds firmly in red for the third straight week and broke below psychological $3.00 support on Monday’s extension of steep downtrend from $3.3140 peak (07 Jun).

Pullback from $3.3140 has nearly fully retraced $2.9370/$3.3140 (Mar/Jun rally) and pressuring key supports at $2.9425 (05 Dec 2017) and $2.9370 (26 Mar) which form a higher base on weekly chart.

Fears of escalation of trade conflict between major economies, continues to heavily weigh on copper price.

Firm break below $2.9425/$2.9370 pivot would confirm double-top ($3.3200/$3.3140) and generate major reversal signal.

Negative daily techs support scenario but hesitation on approach to key $2.9425/$2.9370 supports could be expected as slow stochastic is reversing in deep oversold territory.

Limited recovery is expected to precede fresh weakness, with upticks to be ideally capped by weekly 55SMA ($3.0408) and base of thin daily cloud ($3.0652).

Res: 3.0000; 3.0130; 3.0408; 3.0652

Sup: 2.9670; 2.9425; 2.9370; 2.9000