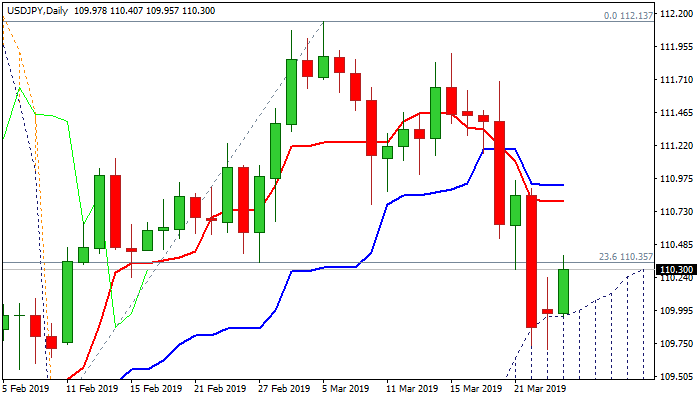

Bears face strong headwinds from rising daily cloud

The pair bounces on Tuesday after rising and thickening daily cloud contained recent weakness and Monday’s action ended in Doji after Friday’s strong fall.

Recovery pressures initial barrier at 110.26 (55SMA) which capped Monday’s action and sustained break higher is needed to complete reversal pattern and signal further advance.

Daily momentum turn higher and stochastic is oversold that could help recovery, but daily MA’s in strong bearish setup may partially offset positive signals.

Current bounce could be seen as positioning for fresh downside as last week’s long red weekly candle weighs.

The pair is moving in the fourth corrective wave of five-wave cycle from 112.13, which should be ideally capped by falling 10SMA (110.88) to keep bearish bias for renewed attack at daily cloud.

Sustained break above 10SMA would sideline downside risk, but further recovery would face strong headwinds from plethora of daily MA’s between 111.02 and 111.43 (30; 20; 100; 200SMA’s) and only break here would neutralize bears.

Res: 110.40; 110.88; 111.02; 111.18

Sup: 109.95; 109.71; 109.25; 109.15