Extended directionless mode is looking for fresh signals from Brexit

Indecision that was signaled by Doji candle on Monday persists, as cable holds within narrow range in early Tuesday’s trading

Cable is awaiting fresh signals from Brexit, after UK parliament passed an amendment on Monday in attempt to re-take control of Brexit process, frustrated by PM May’s government over Brexit.

UK lawmakers are going to vote on a range of Brexit options on Wednesday that would give clearer picture about a deal with closer ties to the EU and would direct the government.

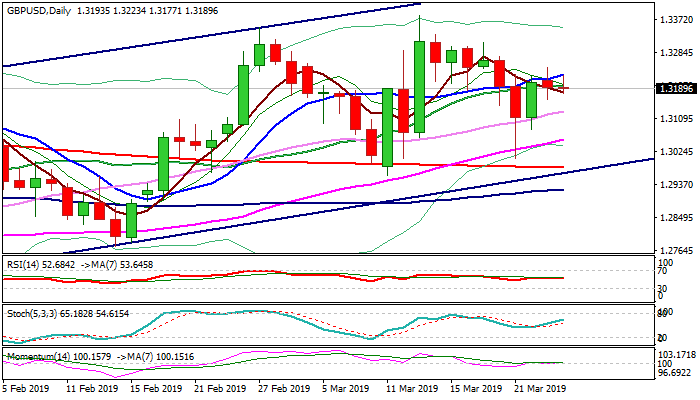

Technical picture remains neutral on flat momentum and RSI, while daily MA’s are in mixed setup.

Near-term action is for now caped by 10 SMA / Fibo 61.8% barriers at 1.3225/37 and weighed by falling and thickening weekly cloud (cloud base lays at 1.3249).

On the other side, rising 30 SMA marks solid support at 1.3130 and keeps the downside protected for now.

Break of either side would generate initial direction signal, with break higher to expose strong barriers at 1.3300 zone and risk stretch towards key 1.3381 barrier (2019 high) on stronger acceleration.

Alternatively, violation of 30SMA would expose 55SMA (1.3054) and risk retest of key supports at 1.2981/77 (200SMA / bull-channel support line).

Res: 1.3225; 1.3237; 1.3249; 1.3272

Sup: 1.3159; 1.3130; 1.3080; 1.3054