Bears hold grip and look for attack at next key support

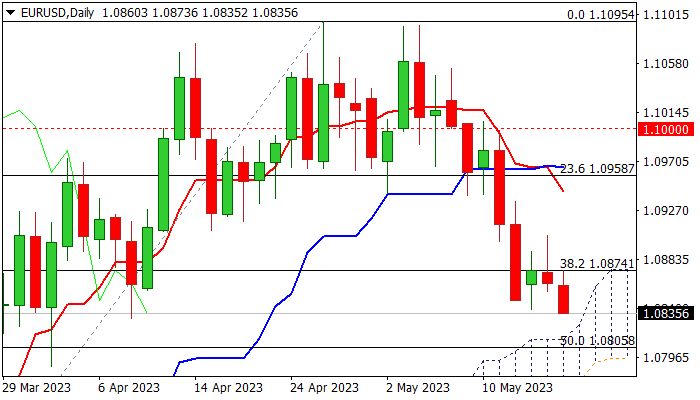

The Euro extends weakness in early European session trading on Wednesday, after the action stayed in a sideways mode in past two days but capped by broken pivotal Fibo support at 1.0874 (38.2% of 1.0516/1.1095), keeping negative near-term bias.

Comments from US policymakers that it’s too early to talk about rate cuts and the Fed should stay strong on inflation despite negative impact on the economy, could be supportive for dollar, in addition to persisting pressure from US debt ceiling crisis, which hurts risk sentiment.

Bearishly aligned daily studies (strong negative momentum / multiple bear-crosses of 10, 20, 30 DMA’s) weigh on near-term action however, strong support from rising and thickening daily cloud (top of the cloud lays at 1.0826) should be considered.

Repeated close below 1.0874 to add to negative outlook, with upticks to offer better selling opportunities while capped by falling 10DMA (1.0931).

Violation of daily cloud top and a nearby 100DMA / 50% of 1.0516/1.1095 (1.0805) to generate fresh bearish signal and expose next pivot at 1.0774 (daily cloud base).

EU inflation report is key event today, with harmonized CPI and core figure (excluding the most volatile components) are expected to remain unchanged in April at 7.0% and 5.6% respectively, which points to stubbornly high inflation and likely to add to ECB’s hawkish stance.

Res: 1.0874; 1.0904; 1.0931; 1.0969

Sup: 1.0826; 1.0805; 1.0774; 1.0737