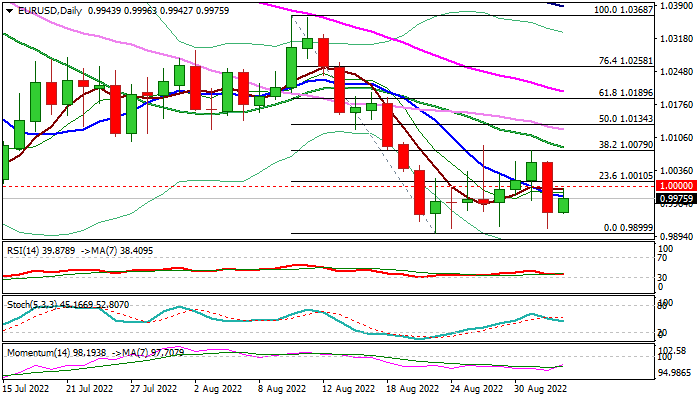

Bears likely to resume after consolidation, US NFP data eyed for fresh direction signal

Near-term action remains directionless after larger bears faced strong headwinds at 0.9900 zone, where a temporary base has formed, but rebounds above parity were so far short-lived, keeping sideways mode and waiting for stronger signals.

Overall picture remains bearish, suggesting that larger bears are likely to resume after extended consolidation, with sustained break below 0.9900 base to spark fresh acceleration lower and expose next target at 0.9800 (Nov 2002 low).

Repeated weekly close below parity would add to bearish signals.

Quiet trading in Friday morning signal that traders await results from US labor report for August, which could spark significant market reaction, in case of surprise in either direction.

Res: 1.0000; 1.0050; 1.0079; 1.0134

Sup: 0.9952; 0.9900; 0.9853; 0.9793