Bears remain firmly in play on demand worries and reinforced by daily bearish engulfing

WTI oil remains in red in early Tuesday’s trading and extends Monday’s strong fall (down 4.1% for the day).

The oil prices came under increased pressure on news of rising Covid cases in China, which revived demand worries and add to downside risk, despite China partially eased its tough Covid rules last week.

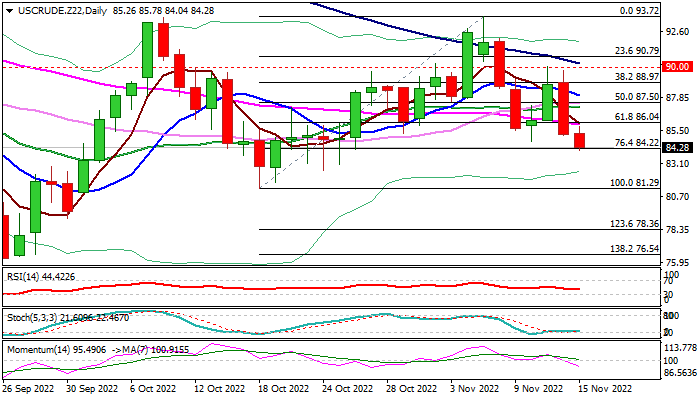

Fresh weakness after repeated rejection at psychological $90 barrier extended below narrowing daily cloud on Tuesday that adds to negative signals, as bears pressure Fibo support at $84.22 (76.4% of $81.29/$93.72 upleg.

Daily studies turned bearish, as south-heading 14-d momentum is deeply in the negative territory and moving averages in bearish setup, with Tuesday’s bearish engulfing adding to downside risk.

Clear break of 84.22 Fibo level to expose troughs at $83.00/$82.60 zone, guarding more significant support at $81.29 (Oct 18 higher low) loss of which to confirm a double-top pattern ($93.60/72) and increase downside pressure.

Broken Fibo 61.8% ($86.04) reinforced by converged 5/55 DMA’s, should ideally keep the upside protected.

Res: 85.78; 86.04; 87.23; 88.08

Sup: 83.04; 82.64; 81.71; 81.29